The buzzword for alternative fundraising has been ICO for a “long time” – “long” in relation to the short lived technical world we are all working in. In actual terms, the hype lasted less than 2 years. There has been plenty of good and bad news around the ICO, very recently a lot more bad than good news.

From good to bad in a very short amount of time. The new buzzword, as it appears, is STO, which is also fund raising, also on the blockchain but that’s about it what the two have in common.

In this article, from a “Maltese perspective”, I am trying to decipher and compare the two in all detail. Dr. Werner & Partner is advising clients on both options:

On the ICO as (future) VFA agents and on the STO as consultants, lawyers and legal project managers.

ICO vs STO – Doing most of the job yourself vs. relying on third parties

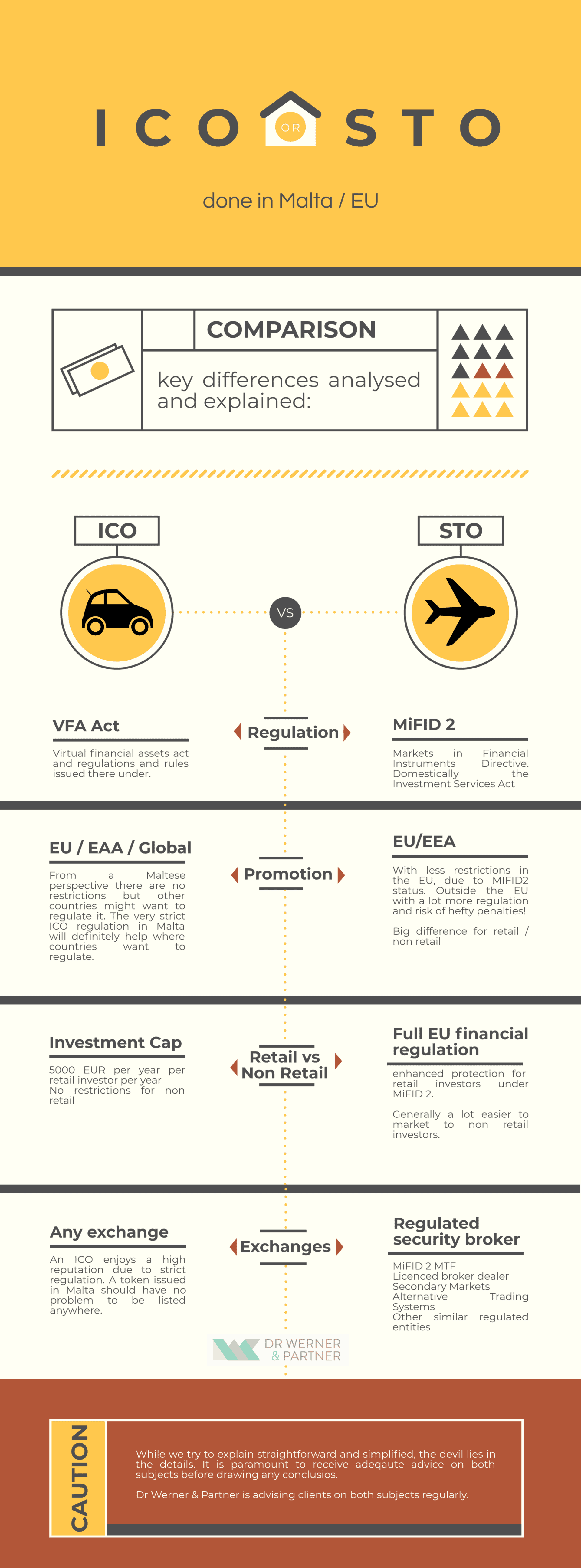

To compare ICO and STO in one article is difficult, as the two appear to be close and are in a way but they still follow very different laws and principles.

It’s like travelling from point A to B by car or by airplane.

Ultimately you just want to be at point B. But whereas you can drive the car (most probably) yourself and need nothing more than some planning, GPS navigation, a lot of coffee and enough money for gas, compared to travelling by plane, it is a very different experience.

Going somewhere by flight you need to rely (most of the time) on third parties like, pilots, airlines, airports, security personnel, flight attendants and more. Flying can be a lot more effective but your role is a lot more passive compared to driving with your car.

Surely you can make your own pilot licence and buy your own private jet, but in 99.9% of the cases, you will not do that.

Very similar with STO’s: You can obtain your own financial / investment / bank / fund licence but for 99% of all cases you would rely heavily on third (regulated) parties.

See a summary of the points in the following video and a detailed analysis followed there under:

[youtube https://www.youtube.com/watch?v=e8VIF4lhB_Q]

ICO in Malta 2019: This is what is going to happen

With the introduction of the “crypto laws or regulations” in November 2018, including the “Virtual Financial Assets Act”, Malta was the first country globally to tackle the issuance of new cryptocurrency in a regulated fashion. The law makers clearly picked up on the massive amount of fraud that had been troubling regulators, investors, participants, banks, search engines and social media platforms – and forged a regulation that would cater for the complete life cycle of newly issued token or virtual financial asset.

This step initially was received with great optimism and companies came swarming on to the Maltese islands.

When the laws and more importantly the regulations and rules got published, it appears there have been some mood setbacks compared to the initial “wow” factor and some of the initial prospects lost interest.

The regulation is strict and at first glance not easy on the eyes. It is not for everyone’s taste and surely not in everyone’s financial reach or better: Not in everyone’s financial will. Whereas some of the potential token issuers might generally have the funds to cater for the array of expenses that tag along with a Maltese ICO, they simply do not want to effort it, and deem it unnecessary for now. Possibly still in comparison with the apparent easier options out there.

Why an ICO in Malta? Why bother?

The argument here might be, that the ICO as a fundraising model has been perverted by too many and we are still comparing the current climate with the climax of 2017. The argument might also be, that only a fraction of such ICOs should have ever been launched in the first place and this fraction would not have shied away from a robust framework and from the required efforts. And that the rest, even with good intentions, should not use an ICO anyway.

In any case, with the coming mass adoption of crypto currency and with bigger players, such as banks to join the party, an ICO with a “stamp” from Malta, will surely be perceived as “high standard, high regulation, diligent, legitimate or similar”.

It is my view that there is no way around a regulated ICO in the future. And Malta offers plenty of regulation.

How an ICO is regulated in Malta

In Malta, we have “invented” a new class of assets, the VIRTUAL FINANCIAL ASSET (“VFA”). This is basically more than a pure utility token and less than a security token. Most ICO’s as we know them would fall in the definition of a VFA.

Any company issuing a new VFA will have to follow the VFA regulation, consisting of laws, regulations and rules.

You find an overview of the “VFA Framework” here: Click me!

The regulation in Malta follows the existing back bone of financial supervision loosely but there are many unique bits and pieces.

Apart from a complete owner and ownership “screening”, the issuing company needs to adhere to a number of policies and procedures. Those policies share affinity with the “normal” financial world. For example you find policies that deal with insider dealing or trading, sensitive information, refund to investors and more.

Great emphasis is also given to the white paper and its contents – to an extent that certain elements, just like in a prospectus must to be included.

Apart from those internal control and good governance aspects, there is also an element of constant external “supervision” or “control”, namely the “Board of Functionaries”. This is a group of professionals that remain in close proximity to the ICO at all times and which / who collectively and /or individually execute another layer of diligence.

There is:

- A Custodian

- A external auditor

- A systems auditor

- A VFA Agent and

- A money laundering reporting officer

Retail vs Non Retail ICO Malta

ICO companies will have to make sure to identify and categorize their investors in two main groups:

- Retail investors

- Non retail / professional / experienced investors

Such categorisation is based on a self declaration by the investor, meaning, the ICO will need, for every investor who wants to be treated as “non retail”, to obtain a declaration that he / she / it has sufficient knowledge / experience and financial resources to be classified as “non retail”.

That of course is simplified, but you get the idea.

It is not as troublesome as the “Reg D” compliance from the USA.

Why the differentiation? There a is maximum amount of investment per retail investor per ICO per year. This amount is fixed at 5000 EUR. Therefore, for any investor who wants to invest more, you need the above mentioned declaration.

Your Malta ICO on crypto currency exchanges

There is some good news for once. Since the regulation around the issuance of a VFA in Malta is so strict, I am not leaning myself too much out of the window when I say: Any exchange will list it. Or even more, want to list it.

I thoroughly believe, that the “stamp” of the Maltese regulation will be equal to a quality seal. Very much like the well known “Made in Germany”, the ICO equivalent will be “Made in Malta”.

As you might know, there are currently many crypto currency exchanges getting ready to get regulated under the same VFA framework – those will surely be more than happy to list any Malta issued token from a regulatory point of view.

Promotion of a Malta ICO

As stated above, the regulation is fairly new, and was as such one of the first, if not the first in the world, a one of a kind. Other countries follow a similar path – but nothing has been harmonised, there is not the one standard or at least one direction. Malta wants to lead the charge, wants to provide a standard, a direction.

Therefore, strictly speaking you would need to check country by country what the rules are. From a Maltese perspective, you can promote wherever you want – apart from the very obvious sanctioned countries or similar.

Since both is not really practical, it is my view, that the nature and degree of the Maltese regulation will give a Maltese ICO a huge credit in front of many regulators. I also believe that generally within the EU / EEA a Maltese ICO should get the benefit of the doubt, also under the freedom of service rule. It is however not guaranteed and we can only encourage clients to seek adequate advice before jumping to conclusions.

The promotion of an STO, in contrast and interestingly enough, is a lot clearer, as you can read here under:

STO Malta 2019: One possible way forward

STO – a definition

DISCLAIMER: The term STO (Security Token Offering) is nowhere defined officially, so it means something else for everyone. In the context of this article, it shall mean and describe ONE possible way on how to issue and distribute a token, that, similar to a share in a limited company, contains the right to participate in the profit of that company. You might want to compare it to an IPO.

Why third (regulated) parties anyway?

As stated above, for an STO you need to rely on third parties. Why?

This is a valid question. Whenever you deal with “securities”, for example in the context of advising, selling, issuing, distributing, managing or similar, there are current laws and regulations in place to regulate anything related.

And not only since yesterday, but since decades.

Even if you deal with “tokenized” securities or “security” tokens – it might have changed the technical shape but it remains a security. And this is where the third party comes into play: a company or person, licenced/authorised or regulated to deal with securities.

In the EU/EEA and in any “normal” country similar rules / laws exist. Countries including USA, AUS, South Korea, Japan, South Africa, Switzerland etc.

Therefore, whenever you consider an STO, consider regulation.

Many companies and providers I have seen, seem to offer “turnkey STO” solutions. In some cases this might be the actual case, however in most of the cases it’s technical service providers that might cater technically for the aspects of a regulated environment, however one can still not just use their services and then start issuing security tokens.

YOU WILL NEED A REGULATED, FULLY LICENCED FINANCIAL OR INVESTMENT SERVICES PROVIDER IN ORDER TO PERFORM AN STO.

This is the first thing you should be looking for. In most cases, due to the strict regulation those service providers are under, they will either have their own technical service provider of choice, that the issuer / client will have to use or they will handle all the technical aspects in-house.

As most of the aspects of an STO are regulated and ruled by laws, you have to be careful that you receive adequate legal advice. You are talking security laws in all shapes and forms so not anyone should and could advice on STOs.

At least from a certain level you will need a lawyer or legal team – a simple “STO Advisor” or similar role / position is not enough, the matter is very complex.

The Dr Werner & Partner legal team – in the apex of the learning curve:

Our very own team of lawyers is continuously learning together with our clients and together with other lawyers and together with the regulators, on a daily basis about this very new topic.

MIFID 2 in the EU: In the EU the regulatory framework or basis for investment companies or investment services companies is called MIFID, the “Market in Financial Instruments Directive”, in place since 2008. The current, updated version is MiFID 2, in force since 2018.

In Malta this was transposed into domestic law accordingly.

One example how Dr Werner & Partner approaches STOs –

“Tokenized Investment Certificates issued by a MiFID2 MTF dealing on own account.”

Wow, that’s a difficult start. Let me explain with a practical example, as this is one very frequently requested service:

A business or start up would like to attract investment in order to scale it’s business, the business aims to issue tokens in return for the investment. The token however should have no utility value, the business might not even have a blockchain business case.

The business only feels, that it could potentially reach most of the investor thought a token fund raise.

The business would like investors to participate in the profit of the business, plain and simple.

In a normal world, the business would now issue bonds or sell its shares or similar. It could issue bonds and tokenize those directly but it could not tokenize the shares or share capital directly.

I have seen one case in Switzerland (where the register of shares for a limited company is not public but only with the company itself, which makes it a lot easier), where a company managed to have the share capital and register tokenized, accepted by the local administration.

Side note: I am fully aware that of course you can pop any share on a blockchain and can transfer ownership however you please – but this is article is about achieving this or a similar result in a regulated, official, government accepted fashion. As much as we are trying to lobby the latter with authorities, currently we have to work with what is available and in close to all of the cases you cannot tokenize share capital directly.

Let’s go back to our example company: How can you tokenize something similar to a share of a company without tokenizing the share itself. Let’s analyse what you are actually trying to achieve. You are selling the right to participate in the profits of your business.

A right is a contract, therefore, let’s stress dear old wiki: “In finance, a derivative is a contract that derives its value from the performance of an underlying entity.”

You see how close we are? It appears a derivative could solve the problem of selling something like a share or a bond which is not a share or bond.

Therefore the answer to the question

“Who can create and sell derivatives in Malta / the EU?”

is the same answer to th question:

“Who can issue and list an STO in Malta / the EU?”

The answer:

A MIFID 2 REGULATED INVESTMENT SERVICES COMPANY – A BROKER / DEALER AUTHORISED TO DEAL ON OWN ACCOUNT – A MULTILATERAL TRADING FACILITY – AN MTF – the “Broker”

This means: If the business engages such broker, mandating it to issue/emit a derivative that derives its value from the performance / profit of the underlying entity/business and if such broker lists/ sells such derivative on it’s platform, the “secondary market”, then we have already one part of the task covered.

But so far we are still in the analogue world, so far no token has been issued.

Find the right broker, and it will tokenize the derivative / the profit participation in your company for you and it will list that token on it’s platform, the secondary market.

Here is where the STO starts:

The general public can register an account with the broker and can buy a token that contains a fraction of the profit rights of the company. The general public can trade this token on the broker’s platform or any other adequately licenced broker, that allows trading of security token (not many currently).

As you can see, this is a very homogene, narrowly regulated playing field, so any service provider offering “compliant STO turnkey solutions” either has a similar licence or is in fact a service provider for brokers, and not for the final client.

Don’t be put off by the idea that you have to register an account with a broker, having thought that this is the blockchain and you transfer however and whenever you want. Very similar to “normal” securities, shares, bonds, derivatives, CFDs etc you can trade those only on regulated entities, and you would have to register accounts with those as well.

If you or I like this or not or if you think this is against the very idea of blockchain: You surely have a point, but it is what it is.

White listing of wallets and smart contract compliance

Assume our derivative has been put onto the blockchain / into a token. While registering your account with the broker, the magic of blockchain starts to unfold:

Any wallet on which the participant would like to receive the security token will have to be white listed with the broker. This means “K Y C’ed” (Know your client), meaning the broker will take your passport, address etc and will “link” this to your wallet. Like this, the broker makes sure, that the investor is who he says he/she is.

But more importantly, when the token is transferred to the investors wallets, there is also a smart contract deployed. Such smart contract will only allow you to transfer the token to a wallet that has been white listed beforehand.

That means, and that is quite brilliant, the token can never be transferred to a wallet that has not been whitelisted for this STO. Meaning, if for example, STOs are forbidden in China or you want to exclude North Korea, this is all being catered for by the smart contract deployed. By the broker.

For a reason: Since the broker is the issuer, a regulated entity, of course it will make sure that everything is super compliant, otherwise this could backfire and jeopardize the licence (which by the way takes about 2 years to get) of our broker.

Promotion / Marketing of the STO

The emitent / Issuer of the token is the broker with all responsibilities that come with an investment service licence. This means, the client cannot promote the STO as the client pleases. This cannot be highlighted enough.

Under most security laws it is not only important that and where the actual issuance and distribution is regulated but also the who, where and by whom promotion and solicitation is performed.

This is where suddenly a lot of grey areas appear and it loses a lot of the clarity. This is not particularly affin to the STO but a general issue of promoting financial / investment services or products.

For this article and in our context, since the broker is MiFID 2 regulated, you are fairly safe to say that, within a certain scope and only by the broker itself, a regulated intermediary and / or in direct liaison with the broker:

Distribution and solicitation for and to EU/ EEA based investors works. Even for retail investors.

Everything outside is on a case to case basis, however a MIFID 2 license enjoys are certain strong reputation, so you do not need from to start from zero when you want to promote somewhere outside the EU/EEA.

The issue with the liquidity

Since this STO as described in the article is within the merits of MIFID 2, the full array of investor protection will have to be regarded, most importantly, if the STO is targeting “retail investors”.

Retail is every investor who is not professional.

Put simply, your average joe, under 100k EUR investment, with no or little own investment or trading experience is a retail investor. Certain criteria have to be regarded and certain processes will have to be followed before the broker can onboard such retail client.

Equally important, once the investor has paid and has received the token: He or she needs to be able to give it back, liquidate the investment in a very short amount of time. You cannot lock up retail investor as you can lock up non retail investors. This is very important for STOs being done as described here: Investors buy a financial product not a share itself.

Therefore, be prepared that the broker will require a certain amount of cash from the STO under his control, in order to pay out exiting retail investors. This is very important for the cash flow calculation.

Liquidity however is also an important commercial aspect, as no broker likes an empty marketplace.

Exchanges and trading of a security token

As briefly explained above, any security including tokenized security can only be traded on a adequately regulated entity – adequately within the EU means a MIFID 2 regulated entity or elsewhere in the world (examples): “trading venue”, “broker dealer”, “securities exchange”, “alternative trading system”.

Not even in Malta, not even with a VFA licence (the crypto licence), a security token can be listed.

Generally speaking, every such regulated platform can list securities token however not every broker might want to, or might have the technical abilities or the authorisation from the regulator – the current players are very limited.

Conclusion:

If you are ready to take the next steps for your fundraising via tokens: We can advise you on the right way and we’ll walk this way with together with you.

Contact us to find out more about ICOs and STOs in Malta.