Reasons for a

Relocation of residence and/ or company headquarters

Who hasn’t dreamed of living on a beautiful Mediterranean island? Good weather almost year-round, crystal clear waters, Mediterranean cuisine, and the relaxed lifestyle of the global South.

While popular destinations include Italy, Portugal, Spain, and Croatia, again and again, people choose Malta or Cyprus. These islands attract visitors every year, not just as a vacation hotbed. But, more and more, they’re chosen as a new home abroad and the location of new businesses.

In the following, you’ll learn some common reasons why people opt to change location, why the EU makes sense as a country of emigration, and what you should pay attention to when founding a company.

The most common reasons for founding a company abroad

What are the countries most commonly chosen?

Why the EU makes sense

If an entrepreneur is considering moving company headquarters, 95% of the time they’ll choose a country that meets their requirements for living, for running a company headquarters, and for lower taxes. These include countries such as the Bahamas, the British Channel Islands, the Cayman Islands, Liechtenstein, the Isle of Man, Monaco, the Netherlands Antilles, Panama, Switzerland, Cyprus, and Malta. Differences between these countries include, of course, their geographical location on different continents and the associated lifestyle, but also the relevant laws, such as tax regulation. Many entrepreneurs reasonably decide against countries that are on the so-called blacklist, such as Barbados, the Bahamas, Tunisia, etc., or the gray list, which means Dubai, Panama, or Mongolia.

What’s more, the geographical location determines flight accessibility and cross-border trade. In short, most emigration destinations are countries in the EU. And there’s a reason for this: the European Union has created economic frameworks that greatly simplify trade within the EU through, for example, the duty-free movement of goods. In addition, the EU has a solid reputation, something that helps companies build networks overseas.

The choice often falls on

Cyprus or Malta

The advantages of company formation in Malta or Cyprus speak for themselves:

- Country within the EU

- Tax-free dividends regardless of the location of the company

- Low cost of living

- Good flight connections

- Mediterranean lifestyle

- > 300 days of sunshine

- Diverse landscape

- Foreign income is tax free

- Flexibility of establishment

- Free internal economy

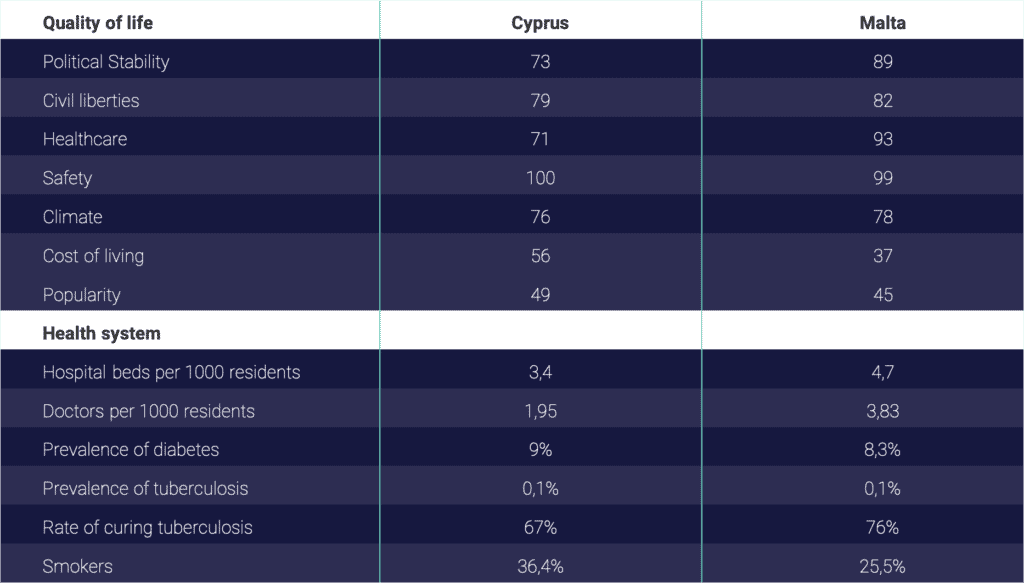

So which country should you choose? Roughly, the two countries differ rather little from one another in terms of taxation. The main difference is that Malta has English as an official language, which is an advantage for companies wanting to expand or seeking new employees in the country of relocation. When comparing the economies of these two countries, Malta also gets another plus point. Cyprus is closely intertwined with Greece, so the economy is still suffering from the effects of the global economic crisis. This factor is also reflected in terms of banks. Malta’s banks are very stable, unlike Cyprus‘. In addition, Malta’s government is very eager to support foreign entrepreneurs. Another advantage: Malta’s healthcare system is very similar to Germany’s or the UK’s. Below, you’ll see a summary of a comparison of the most important key aspects (from WorldData.info).

Now let’s take a look at what emigrants said when asked about their happiness and well-being

Top 5 countries of emigration according to Internations

For individuals, entrepreneurs and companies

Changing location—what to expect?

Changing legislations, new measures & harmonisation of states require extensive knowledge

Once you’ve made the decision to grow your business outside of your home country, you will quickly realize that there are many regulations and laws that make it difficult for you to relocate your company.

Relocating the center of your life and/or business abroad always means the loss of tax revenues for the country you’re moving from, which means the country you’re moving from won’t make it easy for you.

In addition, the constantly changing and emerging laws in the international context on a national and international level will require your consistent attention. This means, in particular, the G20, OECD, and EU regulations as well as the tax authorities fighting with the entire range of possibility of tax evasion. What this means for you as an entrepreneur is that if you are considering a change of location purely for tax reasons, you should abandon your plan yesterday—in the long term, such setups will rarely meet with success.

As you might guess, relocating a business means a lot of bureaucracy and knowledge about the applicable regulations.

However, the sheer volume of these is no reason to panic. There are some ways to simplify the relocation of your company headquarters. Directives and laws within the EU that operate in your favor include, for example, double taxation agreements (DTAs), the EU parent-subsidiary directive, and the freedom of establishment or non-domicile residence.

In short: Yes, setting up a business abroad that’s designed for long-term success is complex. Our tip to you? Leave nothing to chance. Seek advice from experts who are familiar with the relevant regulations and can help you.

But watch out: Numerous techniques that worked 10 years ago no longer work today. Conversely, what this means for you is that bad/outdated advice not only costs you time, but also possibly a slice of your profits later on.

What to take into account: know how

So you want to establish a company?

In addition to the aspects mentioned above, there are many other regulations that should be observed when founding a business abroad. For example, it’s required that you do not have the right of domicile or the right of entry to an apartment in your country of origin. If you do and the tax office catches wind of it, you’ll find yourself accused of tax evasion in rapid order. In this case, the burden of proof is reversed, and you must be able to show to the tax office that you actually live in Malta. In Malta itself, or in any other emigration destination, for that matter, the issue of substance and value creation is an essential point.

Meanwhile, that tax evasion offense also counts as money laundering. Any advisor who is a subject person and is regulated under the anti-money laundering guidelines must report Suspicious Transaction Reporting (STR) to the Finance Intelligence Unit immediately upon suspecting wrongdoing. In layman’s terms? What that means is that advisors are obligated to report you to the authorities as soon as they get a whiff of a money-laundering offense.

CAUTION: “Advisors” who merely set up shop without advising are not subject to this disclosure requirement. However, such company structures as this are doomed to failure because they’re not observing applicable regulations. They may carry on for a few years, but sooner or later a tax office is going to catch on and slap you with additional, retroactive payments (up to 10 years).

Cutting corners at the outset of forming a company can cost you more later than it’s worth in initial savings

Therefore, start right from the start and get advice!

You’re after

The Solution!

We’re a law firm in Malta with certified tax advisors of long experience. We’re in the loop with all the applicable, current international requirements and can therefore help you set up structures that are best positioned, both strategically and legally.

We’re the right choice for your needs as an entrepreneur and offer sound advice in an international context.

Together with a team of lawyers, tax advisors, auditors and accountants, we create the best possible scenario for you.

Due to the diversity of our service portfolio, with experts stemming from every industry, we can offer a holistic solution that also saves you time and money.

Why are we your best option?

ALL-IN-ONE-SOLUTION

Dr. Werner & Partner has been serving clients for over 15 years and starts by offering you a free consultation in English, German, Russian, or Brazilian Portuguese. Dr. Werner & Partner’s broad service portfolio means that you receive comprehensive services from a single source. Even if you don’t benefit from all Dr. Werner & Partner’s services, at the very least it’ll behoove you to listen to the know-how of all our various specialists and see how the advice we provide is truly holistic.

Tax & manage-ment consulting

Book-keeping

Company Formation

Compliance-Check

Banking Service

Auditor team

Payroll accounting

Office & facilities service

IMPORTANT: Dr. Werner & Partner places a great deal of emphasis on it reputation as an honest, transparent law practice. We will therefore refuse requests that are purely tax motivated. Also, we’ll only advise businesses to incorporate in Malta if we truly believe it’s a good fit.

“Resilience – nothing is impossible.”

CEO of DW&P, Philipp M. Sauerborn

Why

We can help you

DW&P has an international team of consultants, both Maltese and German. This is advantageous for you as German tax law has been the leader and will continue to lead the way for all alterations in international tax law. Ultimately, our orientation towards German tax law means our clients are in the best possible position, having to undertake only minor restructuring, even after EU and OECD changes.

In addition, our advisors have many years of experience, having gauged and plumbed all legislation and measures and always striving to stay ahead of developments.

01

Identification of your current situation

Together with a team of lawyers and tax experts we will analyze your personal situation.

02

Needs analysis

You’ll explain your plans and needs to us. If necessary, we’ll involve an expert advisor in the country of relocation.

03

Achievement of objectives

We create a holistic solution for you, taking into account all tax and legal perspectives.

We only take care of serious, practical and authentic set-ups.

Key topics such as fiscal substance, value creation, transparency and good governance not to mention legal & financial benefit have formed a key traits of our strategy and philosophy vis-a-vis third-parties long before the Panama Papers’ scandal highlighted the lack of these principles….

You’ve found the right place.

Our range of services

We can advise and support you in a variety of ways.

How we work

- A team of lawyers, tax experts and accountants will be dedicated to your case.

- We have digitalized aspects of our workflow in such a way that, first off, there are almost no sources of error and, second, the time saved helps us provide you with advice tailored to your individual needs.

- An initial, comprehensive consultation is crucial since, for example, foundations, due to tax consequences and formal requirements, quickly trigger complex chains of causality and these are difficult to alter after the fact.

- We’ll take care of official procedures and all administrative tasks for you, so you can know the basics are taken care of and can instead focus on what you do best: your business.

- ...Especially since requirements such as the 4th and 5th Anti-Money Laundering Directive can lead to an extensive process, in which the registration of a company is only the smallest part of the exercise.

- Thanks to our interdisciplinary team, you’ll be sure that you’re not only receiving comprehensive tax advice, but also legal and financial advice. Finally, this constellation also leads to the fact that you will be informed and advised of new laws coming into force which affect your situation and—if necessary—we’ll guide you through adjustments.

Our Values

Unsere Werte

01

Trust

For us, trust of each other and in each other is the basic building block for long-term partnerships.

02

Honesty

We expect honesty and are honest. If we do not consider your business suitable, we will reject your request.

03

Discretion

To protect your data, we have set up various internal rules and compliance guidelines.

Contact us!

We’ll find

a solution

You’re facing an important decision and are unsure whether and how to proceed?

You’re an entrepreneur and want to grow with your company beyond national borders? Are you looking for a partner you can trust?

Then let us advise you and find out how we can take you and your business to the next level.

Profit from our ambitious team and network!

Ask us anything. Anytime.

Contact us and request a free initial consultation.

Convince yourself of the expertise and know-how of our team.

We look forward to hearing from you!

- PHOENIX BUSINESS CENTRE OLD RAILWAY TRACK 022 SANTA VENERA

- info@drwerner.com

- +356 213 777 00