The ubiquitous term ‘Blockchain’ has been often used in a nonchalant manner yet closer scrutiny is required to disseminate what exactly is meant by: ‘Blockchain Law’. To be both precise and meticulous at the same time, there is no such thing as a conspicuously conceived statutory Blockchain framework. Instead, there are a few laws and supporting documentation which aim to provide some form of legal certainty to all ‘Blockchain’ enthusiasts.

‘Understanding Blockchain’

To further understand what is meant by: ‘Blockchain Law’, we need to initially attempt to understand the term: ‘Blockchain’. Investopedia for example remarks that: ‘Blockchain is literally just a chain of blocks, but not in the traditional sense of those words. When we say the words “block” and “chain” in this context, we are talking about digital information (the “block”) stored in a public database (the “chain”). Moreover, it is stated that: ‘Bitcoin is based on a distributed ledger or rather a specific kind of distributed ledger: ‘a Blockchain’.

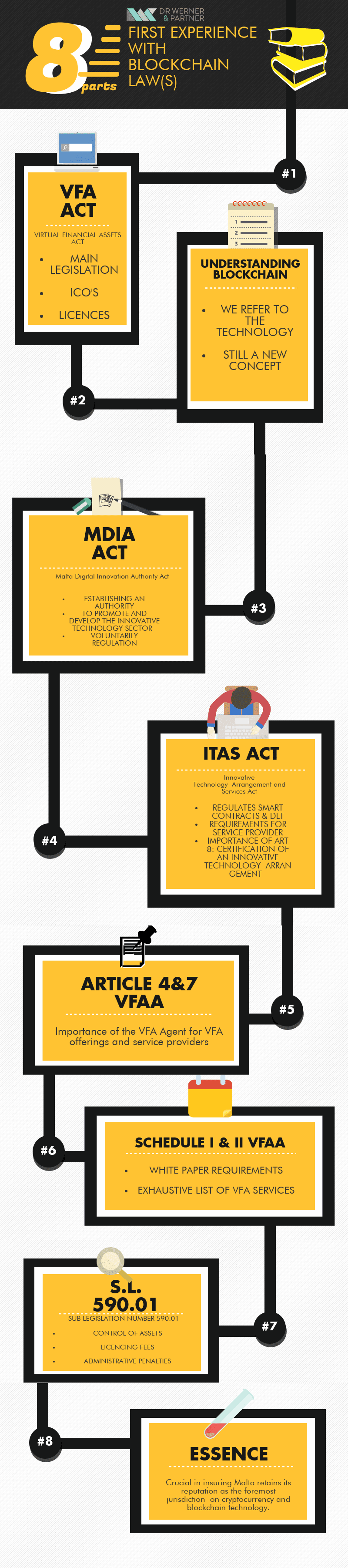

Therefore, for all intents and purposes, when we refer to: ‘Blockchain’ we are referring to the underlying ‘Technology’ that is nowadays already seen as an integral part of the ‘digital society’. As Malta is already aptly termed: ‘Blockchain Island’, this tiny jurisdiction in the middle of the Mediterranean has already been at the forefront of innovation with the recent promulgation of the ‘Virtual Financial Assets Act, Cap. 590’, ‘Malta Digital Innovation Authority Act, Cap. 591’ and the ‘Innovative Technology Arrangements and Services Act, Cap. 592’ of the Laws of Malta. Colloquially speaking, these three pieces of legislation have already been referred to as: ‘Blockchain Laws’.

It is fair to say that given its relative infancy, ‘Blockchain Law’ as such is still not fully operative and/or functional. So much so, that a proper analysis of Blockchain Law should ideally be conducted within a period of five to ten years from its actual promulgation. Nevertheless, it is worth mentioning the most salient features and components of this new regulation.

Virtual Financial Assets Act

When analysing the VFA [Virtual Financial Asset] Framework, from a practical perspective, the starting point certainly has to be the Virtual Financial Assets Act, Cap. 590 of the Laws of Malta. Innovative yet slightly rigid, astutely written yet relatively complex, this Act essentially espouses the doctrine of ‘legal certainty’; that is, establishing a structured and specific framework to ensure that a comprehensive legislation is created in order to ultimately guarantee ‘investor protection’ and the reputation of Blockchain island.

The Act mainly deals with (i) Initial VFA Offerings – that is mainly, the establishment and operation of an ICO [Initial Coin Offering], (ii) general Licensing requirements for persons willing to apply for a VFA Service, (iii) the Board of Administration and its obligations, the (iv) prevention of market abuse, (v) Regulatory and Investigatory Powers, (vi) the Duty of Auditors and (vii) Appeals, Remedies, Sanctions and Confidentiality provisions.

Articles 7 and 14

The most important elements of the Act pertain to Articles 7 (i.e. the requirement for the issuer to ‘appoint and have at all times in place, a VFA Agent who shall be registered with the MFSA) and 14 (i.e. that the application for a license must also be made solely through the VFA Agent]. There have so far been 36 applications for Issuers of VFA Offerings and 41 applications by prospective VFA Agents. In terms of Article 14, there have so far been 182 applications from service providers.

The First and Second Schedules

Experience has shown that mastery of the First and Second Schedules of the VFA Act is paramount for a good understanding of the subject. In fact, this was emphasised by the MFSA throughout the approved-courses for the VFA Agents. The First Schedule deals with general principles that should be found within any VFA Offering Whitepaper. This exhaustive list has already been applied by a number of issuers and its aim is to generally ensure that prospective investors are aware of the all the risks associated with crowdfunding initiatives.

The Second Schedule contains a list of VFA Services and from a practical perspective, these are 1) Reception and Transmission of Orders 2) Execution of orders on behalf of other person 3) Dealing on own account 4) Portfolio Management 5) Custodian and Nominee Services 6) Investment Advice 7) Placing of VFAs and 8) The operation of a VFA Exchange.

It goes without saying that given the current and obvious ‘slowing-down’ of the ICO Market, VFA Services will certainly play a more crucial role in the months to follow.

Subsidiary Legislation

Subsidiary Legislation 590.01 [The Virtual Financial Assets Regulations, 2018], primarily deals with four main features 1) Licensing Exemptions 2) Fees 3) The Holding and Control of Assets and 4) Administrative Penalties and Appeals. This subsidiary legislation makes reference to the four classes of licenses and also stipulates that the holding and controlling of client assets forms a distinct patrimony in so far as liability is concerned. To also note that the MFSA has published two Rulebooks [Chapter 1- VFA Agents, Chapter 2- Issuers of VFAs at the time of writing] which should also be read and analysed as well as numerous Guidance Notes, Consultation Papers & Feedback Reports.

The MDIA Act

The ‘Malta Digital Innovation Authority Act’ primarily establishes this organisation and enshrines the guiding principles of this Authority, that are mainly: the promotion and development of the innovative technology sector and the development of Malta as a centre of excellence for innovative technology.

Moreover, the Act also mentions the ‘Functions’ and ‘Conduct of Affairs’ of the Authority and it is specified that the MDIA is a ‘body corporate having distinct legal personality with legal and judicial representation vested in the Chairman’. In this connection, the Board is tasked with Regulatory powers, enforcement and sanctions. An interesting concept is the encouragement of ‘co-ordination with other national competent authorities’ including the MFSA, Malta Gaming Authority, Malta Information Technology Agency, Malta Competition and Consumer Affairs Authority and the Malta Statistics Authority.

The ITAS Act

The much-anticipated ‘Innovative Technology Arrangements and Services Act’ primarily caters for the voluntary application for certification of DLT [Distributed Ledger Technology] and Smart Contracts. More importantly, it also provides a structure for the registration of System Auditors and Technical Administrators.

This Act also contains the registration requirements for providers of Innovative Technology Services. The Registration process focuses on the service provider being fit and proper, qualifications and experience of the service provider, the technical resources or third-party support of the service provider etc…The most salient article in the ITAS is undoubtedly Article 8 which deals with the ‘certification’ of any prospective ITAS. To also note that there are several Guidelines which have been issued by the MDIA which certainly deserve a thorough reading by all and sundry.

Conclusion

As previously stated, practical and hands-on application of ‘Blockchain Laws’ is still very much a novel concept. However, practitioners and prospective clients would do well to familiarise themselves with the inherent feel of the overall legislation – which one can surmise will certainly play a crucial rule in ensuring that Blockchain Island thrives on its well-founded reputation of ‘innovation’ & ‘technology.’

Disclaimer*

The above-mentioned article is simply based on independent research carried out by Dr. Werner and Partner and cannot constitute any form of legal advice. If you would like to meet with up with any of our representatives to seek further information, please contact us for an appointment.