How to get more liquidity in times of Coronavirus. Tips from experts.

Confidence in the financial markets has weakened since the financial crisis of 2008. Many companies are currently asking themselves how to proceed. Small and medium-sized companies, in particular, are facing an unprecedented challenge. Covid 19 – the virus that is turning our entire economic system upside down has brought about unnecessary and unforeseeable levels of discomfort.

In this connection, the German government has already announced tax measures. The government is planning liquidity support in the billions which consequently means that Germany as an economic country may be able to protect its companies with such packages of measures. But what about other countries?

The fact is that companies have to manage their financial resources as best as I can. There must be sufficient liquidity reserves to pay employees – even if no or little revenue can be generated. The solution? Increase liquidity and build reserves.

According to experts, the virus will accompany us for another 1-2 years. So what can be done to maintain financial resources for as long as possible?

Liquidity crisis

A liquidity crisis can also arise in healthy companies if circumstances such as Covid 19 (Coronavirus) or the financial crisis in 2008 occur, which result in short-term obligations such as the repayment of loans and payment of employees no longer being able to be met. In order not to repeat the events of 2008, measures must be taken early on to ensure that sufficient liquidity and reserves are available to survive in the market.

Definition of liquidity and liquidity ratios.

Liquidity can be defined as the ability of the company to meet its payment obligations at all times, on time and in full.

A distinction should be made between relative liquidity (financial plan liquidity) and absolute liquidity (asset liquidity).

Financial liquidity exceeding the available cash of the due liabilities

Asset liquidity describes the liquidity of an asset, i.e. the possibility of using or exchanging assets as means of payment

Determination of the liquidity situation

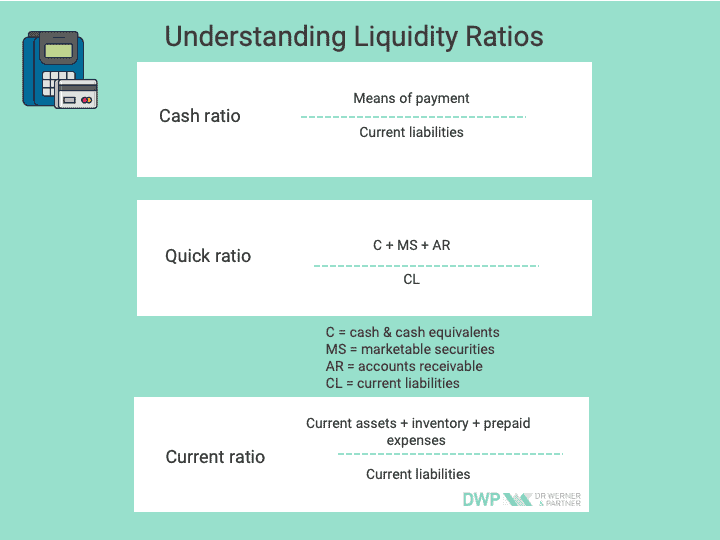

In practice, the liquidity position of companies is determined by means of liquidity ratios.

Interpretation:

Quotient > 1: current liabilities covered

Often: Cash ratio < 1*

*Some companies, however, have a first-degree liquidity of < 1, as not all current liabilities are due at the time of observation and a high level of cash and cash equivalents due to a lack of interest runs counter to the goal of profit maximization.

Quick ratio > 1**

**All the same, at least the 2nd-degree liquidity should be above 1 since in addition to the short-term liabilities recognizable from the balance sheet, personnel costs and other expenses whose due date is not evident from the balance sheet must also be settled.

Measures to increase liquidity

General liquidity management

- Preparation of a liquidity plan (Prepared Liquidity File downloadable below!)

- Definition of spending priorities

- Stop spending

Fixed assets

- Sale of non-essential assets (land, machinery, vehicles, etc.)

- Sales-and-lease-back

- Renting of unneeded rooms, unused machines, vehicles

- Possibilities of outsourcing certain activities

- Review planned investment

- If necessary, lease rather than buy investments

Inventories

- Check stock level (inventory turnover) and reduce

- Shift stock keeping to supplier

- buy on commission

- Review and optimize the ordering system

- Set production to stock

Claims

- Invoice completed orders immediately (an invoice with delivery) Issue partial invoices for partially completed services

- Agree customer prepayments and installments in the future

- Invoice finished orders immediately (an invoice with delivery)

- Shorten payment terms for customers

- Create payment incentives (e.g. customer accounts)

- Push advantageous means of payment (cash, direct debit, discount bill)

- Dunning overdue receivables immediately

- Check dunning system

- In case of unsuccessful reminder: judicial dunning procedure

- External debt collection (a collection agency)

- Monitor and document customer payment behavior

- Avoid payment defaults by customers through credit checks

- Factoring

- Replace security retentions with performance bonds

- Sales financing via the bank

Equity

- Private deposits (private reserves)

- Recovery of outstanding deposits

- Reduce private withdrawals (cost of living) to a minimum

- Review contributions to the pension scheme

- If necessary, reduce contributions to the compulsory craftsmen’s insurance (exemption from compulsory insurance due to insignificance or fulfillment of the compulsory insurance period, auxiliary craftsmen’s business, income-related contribution)

- Temporary suspension or possible termination of life insurance policies

- Check health insurance for possible savings

- Temporarily interrupt savings contributions (building society etc.)

- Check donations, membership fees, etc. and if necessary reduce or avoid them

- Acceptance of new shareholders (e.g. dormant partner, capital investment company)

Long-term loans

- borrowing from relatives or acquaintances

- Rescheduling of excessive current liabilities

- (e.g. with LfA consolidation loans)

- Agreement of a suspension of loan repayments

- Substitute loan (e.g. in the case of public loans with too short a term)

- Repayment deferral

- Review of interest rates

- Agree on grace periods when financing necessary new investments

- (e.g. public loans)

Current liabilities

- Increase of the working capital loan (e.g. current account credit line)

- Use payment deadlines for invoices (e.g. from suppliers) as far as possible

- Select advantageous payment type (for example, check/bill of exchange procedure, bill of exchange, check)

- Payment of urgent commitments in installments

- Make concrete agreements with main creditors (e.g. payment by installments)

- Regulate relations with small creditors (prevent insolvency filing!)

- Arrange settlement with creditors (if necessary against debtor warrant)

Expenses

- Explore ways to reduce personnel costs

- Review voluntary benefits and special payments to employees

- Reduce overtime instead of paying out

- Reduction of advance tax payments

- allow tax payments to be deferred

- A critical review of all expenses and, if necessary, reduction

Proceeds

- Completing orders that have already been started as quickly as possible

- Quickly deal with remaining work and complaints about individual orders

- Marketing measures

Comments: The measures listed above serve to bridge short-term liquidity bottlenecks. It should be noted that these measures lead to an improvement in liquidity in the short term, but that other ways and means should be considered in the long term.

Reserves

In times of potential bottlenecks, the formation of reserves is another option, in addition to improving liquidity, for securing the existence of companies.

Reserves = liabilities + components of equity.

A distinction can be made between open and hidden reserves.

Open reserves = are shown openly in the balance sheet and must not, in principle, reduce taxable profit. They must be added to equity for tax purposes.

Hidden reserves (or hidden reserves) = are disclosed through the sale or withdrawal of assets or the sale or discontinuation of operations. Taxable profit must be generated in the amount by which the disposal consideration or the going concern value exceeds the book value of the WG at the time of the sale or withdrawal. A disclosure (realization) of hidden reserves occurs in the event of withdrawal or the event of the cessation or sale of business operations.

How much reserves should one have?

The rule of thumb for private individuals is that one should have at least 3 net monthly income reserves. For companies, however, the question is not so easy to answer. Here it depends on whether you are obliged by law to pay a certain amount or whether you can set aside voluntary reserves. So there is no correct lump sum here. However, you should check whether you have to set aside money for tax and investments.

Difference between reserves and provisions

| Reserves | Accrued Liabilities | |

| Balance of accounts | Equity capital | Borrowed capital |

| – Formation according to the law or company statutes. These are used to prevent possible losses (not known whether loss will occur at all)

– Should help companies to secure future payments and keep dividend payments constant – Creation of a reserve = increase in equity without reducing the profit |

-Represents expense & thus influence the annual profit, which is reduced

– Provisions are made to offset future financial losses and liabilities – a liability is assumed to be certain to materialise when it is created – Creation of provisions = coverage of future liabilities Obligation yes (corporations, depending on law and articles of association) as soon as the situation requires |

|

| Fixed purpose | free of purpose | for specific purposes |

| Effect on profit | profit without effect on profit | loss Minimising profit |

A tip from the tax expert: Try to save taxes. You can use these saved taxes as a reserve.

Do you need help?

Here at DW&P Dr. Werner & Partner, we are specialized in international tax law and are happy to help you. Feel free to contact us via: info@drwerner.com or call us on +356 213 777 00.

We look forward to hearing from you.