Introduction

As many of you may know, a “Classic” bank is the usual financial services provider which offers a whole spectrum of financial services, including but not limited to Branch Services, ATMs, Internet Banking, the Issuing of VISAs and Cheque Books, amongst others.

The current situation with such banks is that they seem like they are not accepting Fintech Companies as their clients. But why?

Fintech Companies, which are gaining popularity in the field, are struggling to open a trading or an operational bank account because of their company activity. Banks seems to be taking an old-fashioned approach and are generally refusing applications from companies which are related to blockchain or DLT activities.

Companies and Introducers are now faced with a situation where they need to seek other solutions outside Malta or seeking other institutions instead of the classic banks. Other institutions seem to be drifting away from the traditional approach, but banks are showing their unwillingness to address this growing market. One would ask whether such resistance from the banks will continue.

Blockchain operators vs Cryptocurrency operators

Cryptocurrency is a platform for digital currencies, whilst Blockchain is a medium where information is stored and recorded, and it also includes the data of transactions. Whereas cryptocurrency is a tool, blockchain is the network whereby a transaction can come into effect.

There is a distinction between Blockchain Operators and Cryptocurrency Operators which even banks need to take into consideration. However, banks are still not distinguishing between cryptocurrency and blockchain.

The thing is that Banks are not making such distinction when a Fintech Company seeks to open a bank account. Banks are considering both operators to fall within the same business segment. Such business segment is being described as risky when compared to other segments.

In the author’s opinion, had it been only blockchain operators seeking to opening a bank account, the bank’s approach would have been different, but since cryptocurrencies were introduced the risk was higher. The reason for this may be because banks see cryptocurrencies as volatile. For such reason, banks should be issued with official guidelines so they can understand the difference between operators and to be able to understand better this business segment.

Authorities in Malta seems to be struggling to provide guidelines to banks, so the banks may not feel comfortable changing their approach. A good framework should give more comfort to the extent that many of these operators who want to obtain their License in Malta would have already gone through the scrutiny of authorities.

A Fintech Company opening a business account?

Every company which has its commercial activity in Malta must have a bank account. Fintech companies are in line with other “traditional” companies, as the procedure is the same for all companies.

Before, Banks were waiting for feedback of the MFSA but now these clients are still not being on-boarded by the banks. Dozens of companies involved in blockchain and cryptocurrency are choosing Malta as a result of the government’s push to be a front-runner in this sector – but they are encountering resistance when they try to open bank accounts.

Banks might be more comfortable in including Fintech Companies within their risk appetite when licenses are issued.

Reasons!

Fintech Companies are more popular nowadays, but the scenario of Fintech Companies and banks does not seem to be in the equation. In fact, at the moment, there is not a single classic bank in Malta that is specifically willing to work with Fintech Companies. When approached with a VFA Client, banks are politely declining such clients by saying that they fall outside their risk appetite.

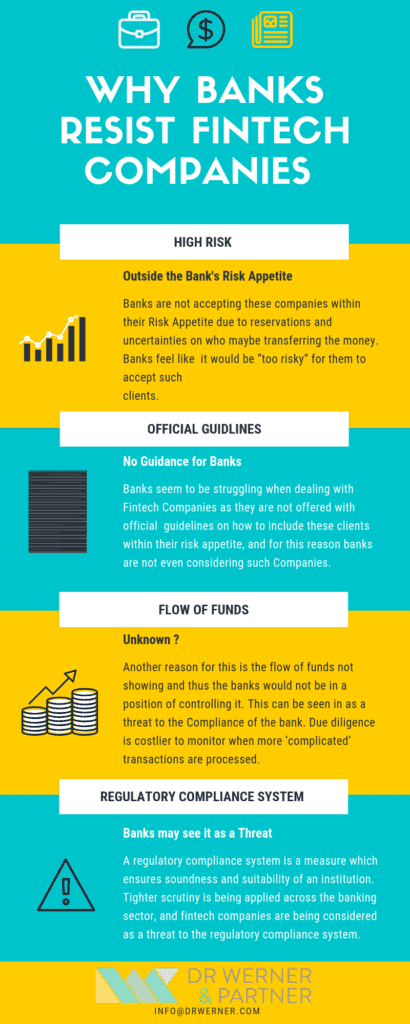

The main reason why banks are not accepting Blockchain/DLT Companies is because they consider such companies as High Risk. Thus, most of the classic banks are not allowing these companies within their Risk Appetite due to reservations and uncertainties on who maybe transferring the money.

Currently, banks advise introducers and prospective clients that if they are approached with a Blockchain/DLT Company they will not accept them as their clients. Banks feel like there is not a structure regulating this sphere and thus it would be “too risky” for them to accept such clients.

Also, banks seem to be struggling when dealing with Blockchain/DLT Companies as they are not offered with official guidelines on how to include these clients within their risk appetite, and for this reason banks are not even considering Blockchain/DLT Companies.

Another reason for this is the flow of funds not showing and thus the banks would not be in a position of controlling it. This can be seen in as a threat to the Compliance of the bank. Due diligence is costlier to monitor when more ‘complicated’ transactions are processed. The growth and formation of a system which is in line with regulatory compliance requirements is a very important task for banks.

A regulatory compliance system is a measure which ensures soundness and suitability of an institution. Tighter scrutiny is being applied across the banking sector, and fintech companies are being considered as a threat to the regulatory compliance system.

The Banks are aware that monitoring the Fintech sector would require a huge amount of resources, expertise and knowledge. This would certainly create additional challenges for the bank, but will they accept this challenge?